Everybody has probably heard about a Bitcoin miner, but what are these people actually doing?

First of all, if you have not read the Bitcoin whitepaper you should. Check it out here.

Little history

The first Bitcoin block #0 was mined back in 2009 (2009-01-03) by the unknown Satoshi Nakamoto. This was the very start of the Bitcoin network.

The Bitcoin network have since then had an uptime of 99.98%. Only two downtime periods in 2010 and 2013 around 14 hours and 47 minutes totally. Since 2013 the uptime has been 100% – which is pretty impressive for a public decentralized monetary network.

The stats:

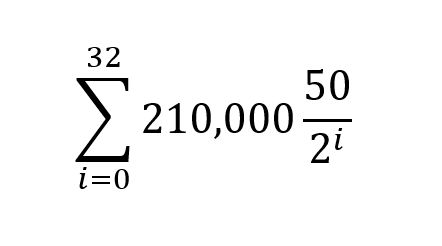

21,000,000 (21 million) BTC will be generated according to the Bitcoin protocol.

Approx. every 10 minutes (600 seconds) a new block is mined and a Bitcoin block reward (subsidy) goes to a lucky miner/mining pool.

When people do transactions using BTC they also pay a fee, this fee is something miners earn.

Every block a lucky miner/s earn = Subsidy + Fee

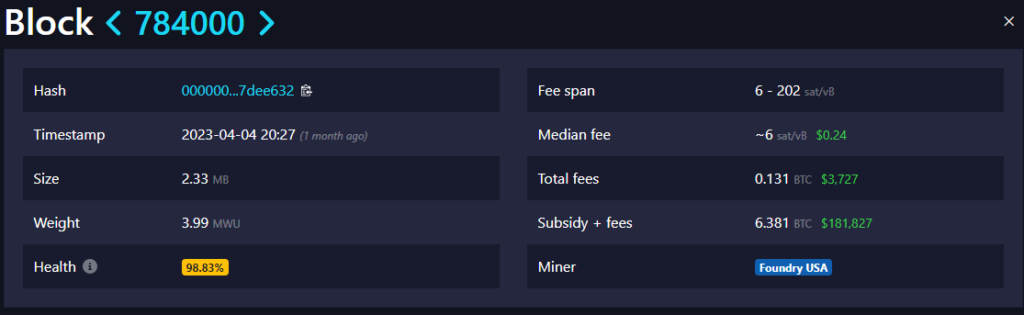

Take a look at this block which I will use as an example:

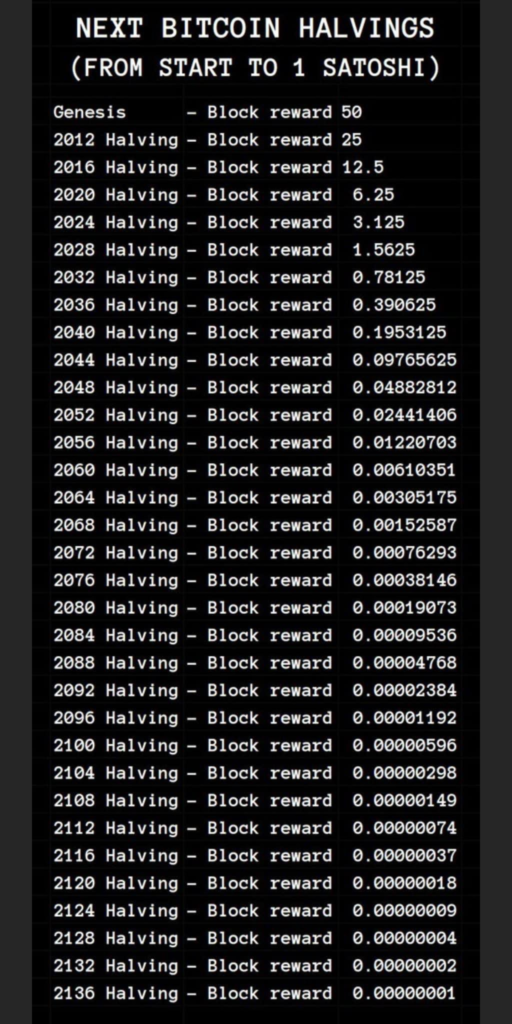

The block reward is lowered every 210,000 blocks also called halvings, checkout the scheme here

If you were lucky and mined block 784000 by yourself you would have gotten 6.25 BTC + 0.131BTC (fee) = 6.381 BTC. This was equivalent to $29.000*6.381 = $185,049 (includes the fee).

Many people join a mining pool and then share the reward with the rest of the pool. If you had joined a pool and mined block 784000 you would have had to divide the hash rate you supplied with the total hash rate of the pool. So if you had supplied 1% of the total hash rate in the pool you would have gotten 0.06381BTC (minus a pool fee 1-3%).

Check this Block the subsidy + fee was 12.951 BTC, so the fee was higher than the subsidy.

The Bitcoin protocol is based on the Nakamoto consensus mechanism and Proof of Work (PoW).

To participate in mining Bitcoin blocks and secure the network you need a mining rig, let´s go deeper.

Deeper

The Bitcoin Network is based on the universal secondary source of energy called electricity (the flow of charge or electrical power). Miners compete to get block rewards in BTC by using electricity, an internet connection (cable/RF) and mining rigs (computerized devices) with ASIC chips (application-specific integrated circuits).

The Bitcoin Network uses different algorithms like the SHA256 (Secure hashing algorithm) for verifying transactions and SHA256, RIPEMD-160 with ECDSA (secp256k1) for managing/creating addresses (You don´t need to understand this nerdy stuff).

You have probably heard miners talk about “what is the current difficulty”, “The hash rate is peaking” and “WTF this block only took 9 minutes”, let´s discuss how to calculate difficulty, hash rate and block time in another blog post.

I want to start mining

- You would need to buy a mining rig.

- You would need electricity (the cheaper the better), maybe your solar panels/windmill or your small backyard nuclear plant produce more power than you can use – Perfect you can use it for producing clean BTC/money.

- You would need a good internet connection (Cable or RF).

Then you are good to go!

But how do I know what mining rig I should buy?

You can mine with your normal computer but the chance of getting a block reward is almost zero. Bitcoin started out with using simple CPUs(central processing unit) back in 2009, when Satoshi Nakamoto started mining. In 2010 miners moved to more efficient GPUs(graphics processing units). Already in 2011 miners moved to FPGAs (field programmable gate arrays). In 2013 miners moved to the first ASIC (application-specific integrated circuit) mining rigs. These ASICs mining rigs have since then become better and the chips smaller. So, you would start buying an ASIC mining rig.

There are many manufactures of these rigs and you would have to look at the most efficient ones. Miners change their mining rigs quiet often so they have the best gear, let´s remember it is a game, better gear higher chance of getting the reward.

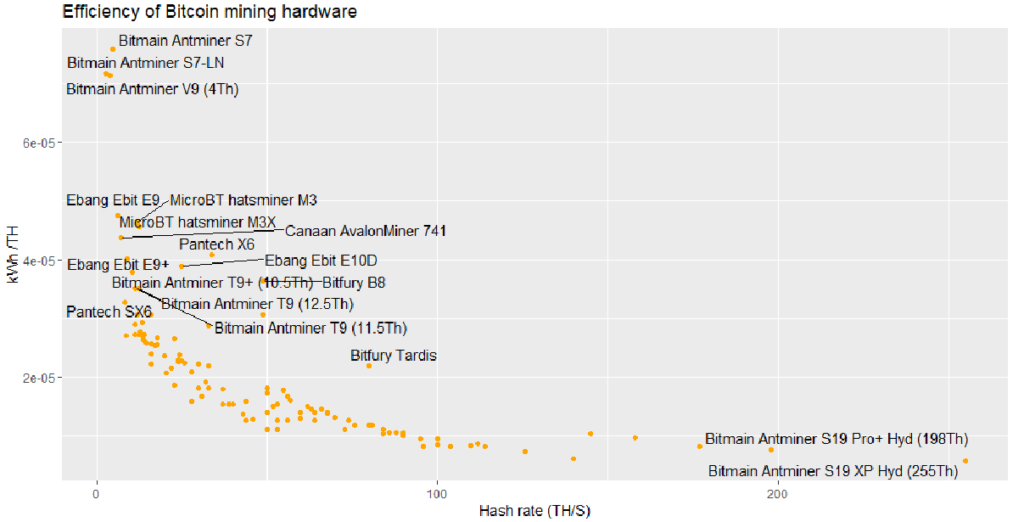

For your help I have made a chart here so you can see what the most efficient mining rig is at the moment.

The most efficient mining rig you can get at the moment is a Bitmain Antminer S19 XP Hyd(255Th).

This mining rig has an average hash rate of 255Th. It pulls 5304 Watt. The efficiency is 20.8 J/TH or 5.77E06 kWh/TH.

Here are some cool people mining BTC

Powered by BTCPayWall