I admire Nikolai Kardashev’s work immensely. His scale is a brilliant way to measure civilizations’ technological prowess based on how they harness energy. It’s a captivating way to categorize the potential of extraterrestrial societies.

The three classifications, from Type I to Type III, signify levels of energy mastery that are mind-boggling. From a civilization using all available energy on its planet to harnessing an entire star’s power or even controlling energy on a galactic scale, it’s like a roadmap to what could be possible.

The scale consists of three main types:

Type I Civilization 1016 W: Capable of harnessing all available energy on its native planet (Earth). This might encompass optimizing energy sources like nuclear (fission and fusion) solar, wind, geothermal power, along with refining energy production and consumption.

Type II Civilization 1026 W: Possess the ability to harness the energy emitted by an entire star. This could involve constructing colossal structures, such as Dyson spheres or swarms encircling the star, to capture its energy output.

Type III Civilization 1036 W: Capable of controlling energy on the scale of its entire galaxy. This might encompass harnessing the energy output of numerous stars, potentially utilizing advanced technologies or methodologies currently beyond our comprehension.

Kardashev’s scale doesn’t explicitly detail the methods or technologies a civilization might use to ascend these levels, but it implies that progression involves increasingly efficient methods of energy capture, storage, and utilization.

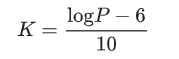

Carl Sagan expanded upon the Kardashev Scale by utilizing data extrapolation. He introduced a continuous function to quantify the scale, denoted by the index K, where the variable P signifies the energy consumption rate measured in Watt.

Currently, mankind is measured on the scale at around K = ~ 0.7276. Humanity has yet to achieve even the first level of civilization on the Kardashev Scale.

However, the scale is more theoretical than prescriptive. It’s important to note that reaching higher levels on the Kardashev Scale involves significant technological, societal, and possibly even evolutionary advancements. Achieving these levels might necessitate breakthroughs in physics, engineering, energy generation, and resource management, among other fields.

Exploring ways to ascend the Kardashev Scale involves considering ambitious possibilities

Interstellar travel and colonization: Venturing beyond our home planet to explore and colonize other celestial bodies opens doors to new energy resources. The expansion across planets, star systems, or even galaxies could unlock diverse energy sources essential for a civilization’s growth.

Advanced energy technologies: Pushing the boundaries of energy capture and utilization is pivotal. Advancements in fusion reactors, and even unconventional sources like black holes or dark matter could revolutionize energy generation, fueling a civilization’s progression.

Harnessing exotic energy sources: Imagining harnessing energy from celestial phenomena like quasars, gamma-ray bursts, or tapping into vacuum energy pushes the limits of technological ingenuity. These exotic sources might harbor immense energy potential for highly advanced civilizations.

Yet, while Kardashev’s scale gives us a framework to contemplate energy utilization in civilizations, the routes to ascend this scale remain speculative.

Achieving higher levels would demand remarkable strides in scientific comprehension and technological prowess, inviting groundbreaking advancements to redefine our understanding of energy.

What can Bitcoin do?

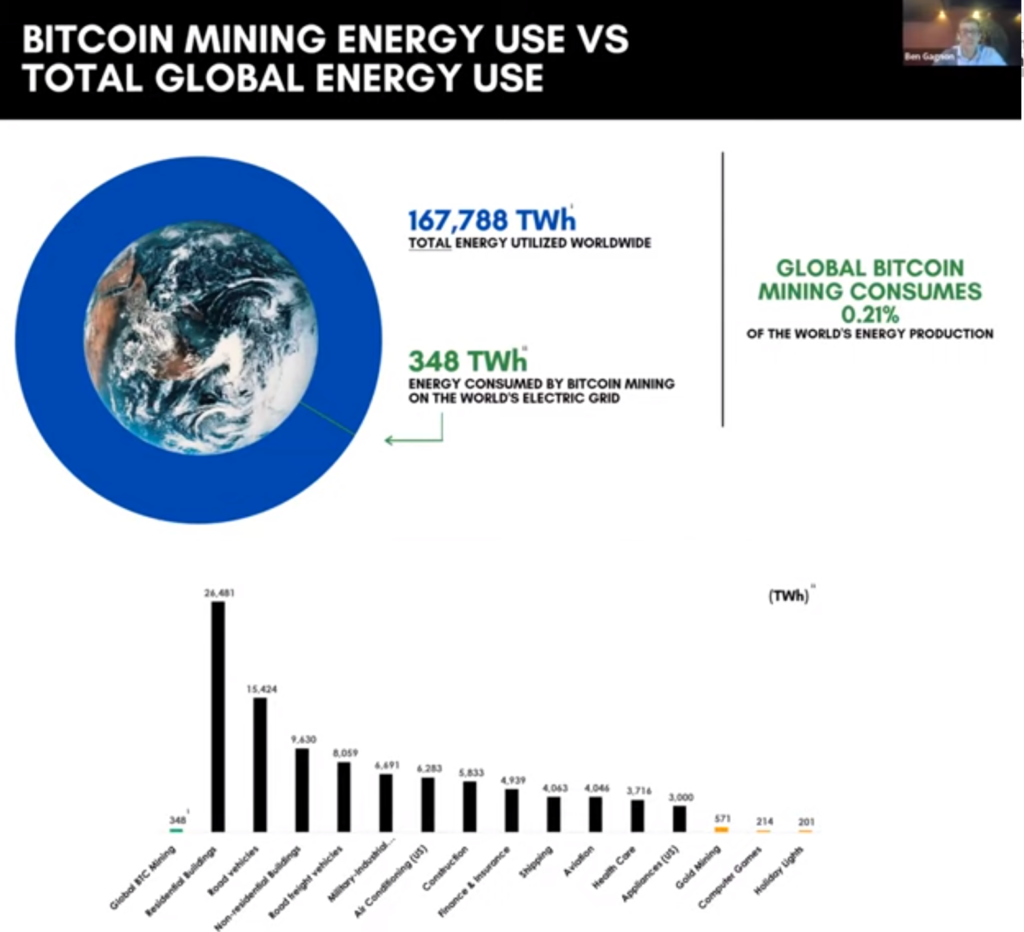

Bitcoin isn’t a direct vehicle for propelling civilizations up the Kardashev Scale, measuring cosmic energy mastery. But, the idea of a currency backed by electricity and mining hardware stems from the concept of tying the value of a currency to something tangible and resource-intensive.

Bitcoin symbolizes a groundbreaking approach to decentralized finance and value transfer, offering potential implications for civilizations aspiring to higher Kardashev echelons.

Global currency: Bitcoin, as a decentralized digital currency, transcends borders and authorities. In a sprawling civilization spanning planets or star systems, a universally accepted, borderless currency like Bitcoin could streamline interstellar trade and transactions. There are still some limits with the speed of light, slightly touched in this article.

Decentralized technological advancement: Built on blockchain technology, Bitcoin offers secure, transparent, decentralized record-keeping. This tech’s adoption might prove pivotal in managing intricate systems, communication, and resource allocation within advanced civilizations, sans a central authority.

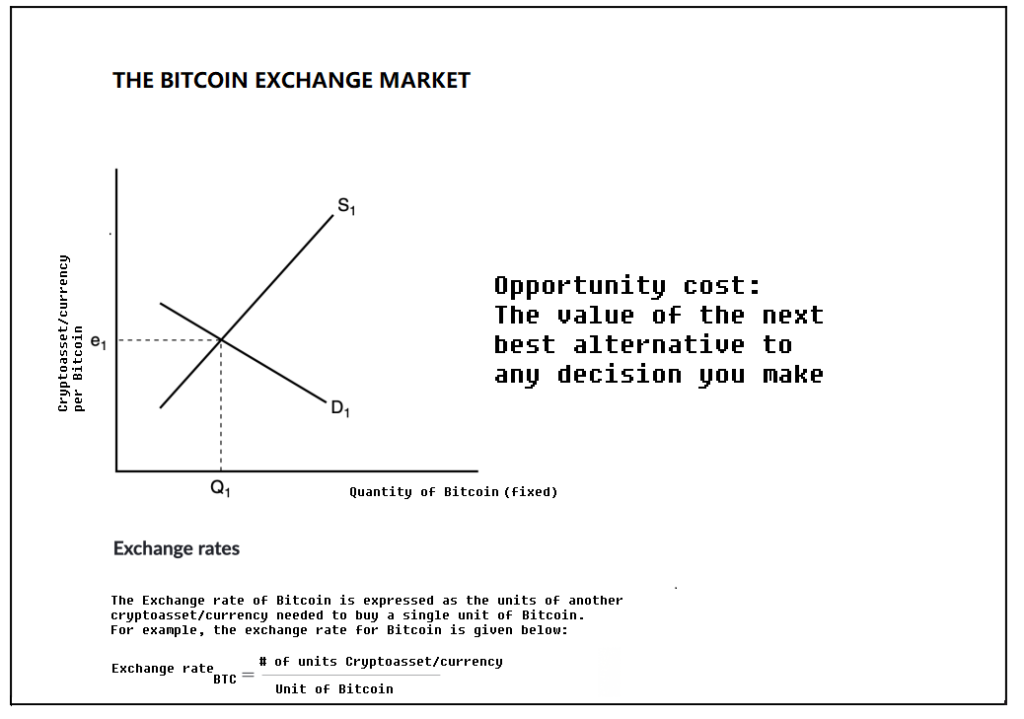

Electricity as a measure of value: Electricity is a fundamental resource in modern society and increasingly crucial for technological advancement. A currency backed by electricity implies that its value is directly linked to the energy expended to produce it. This could provide a more concrete and quantifiable basis for the value of the currency.

Resource allocation and efficiency: The blockchain’s transparent tracking of transactions could revolutionize resource management in a multi-planetary society. Bitcoin could optimize advanced communication, robust infrastructure, resource allocation, tracking, and management across colonies, enhancing energy distribution and utilization.

Chip industry and mining hardware: Bitcoin’s proof-of-work mechanism demands specialized hardware like ASICs for mining. This pursuit has fired up innovation in the chip industry, driving companies to craft more potent, efficient chips tailored for Bitcoin mining. The result? A leap in chip manufacturing prowess, pushing the boundaries of computational capabilities and efficiency.

Quantum computing and security: Quantum computing poses a looming challenge to conventional cryptographic systems, including those safeguarding Bitcoin. The immense computational might of quantum computers threatens to crack existing encryption methods. Yet, discussions swirl around the quest for quantum-resistant cryptographic algorithms. Bitcoin’s blockchain is the proving ground for developing and scrutinizing these quantum-resistant cryptographic solutions. Shielding the network from potential quantum threats stands as a focal point in ongoing research within the Bitcoin community.

Incentivizing innovation: Bitcoin’s mining concept incentivizes securing the network through computational power. By tying a currency to electricity, there’s an inherent incentive to produce more energy efficiently. In an advanced civilization, where energy management is crucial, this could encourage the development of sustainable energy sources and efficient energy distribution systems. This model could extend to incentivizing scientific research or technological breakthroughs vital to civilization’s growth, nudging progress on the Kardashev Scale.

These elements could form the bedrock of managing energy, resources, and interactions within a multi-planetary or interstellar civilization, potentially aiding the journey toward higher Kardashev Scale levels.

Why not Fiat Currencies/CBDC:

The scales tip differently between fiat currencies/CBDC and the journey up the Kardashev Scale.

Fiat currencies/CBDC, like the dollar, euro, yen or yuan rely on trust in governments and economies rather than tangible assets. But for a civilization’s ascent up the Kardashev Scale, they might not quite fit:

Global limitations: Fiat currencies are tied to specific nations, hindering seamless trade across celestial realms. Imagine an advanced civilization needing a universal, borderless currency for spanning planets— a need beyond what fiat currencies can meet.

Centralized control: Controlled by central authorities, these currencies don’t align with the decentralized ethos needed for managing resources across diverse celestial bodies. In an advanced society, decentralized systems might ensure transparency, security, and efficiency in transactions and resource management.

Intrinsic worth: Fiat currencies lack inherent backing by physical assets like gold. For a multi-planetary civilization, a currency tied to a tangible resource, say electricity or energy, could better reflect actual resources spent, offering a more stable valuation basis.

While fiat currencies serve our current economic needs, their centralized nature and lack of intrinsic value might not befit an advanced civilization navigating multiple planets or star systems. A currency rooted in tangible resources could better align with the complexity and scale of a multi-planetary society’s economic requirements.

My take

As civilizations strive for higher echelons on the Kardashev Scale, the choice of currency becomes pivotal. Bitcoin emerges as a beacon of innovation and possibility compared to fiat currencies.

Bitcoin’s underlying technology, ethos, and adaptability make it a promising candidate for civilizations seeking to ascend the Kardashev Scale. Its borderless nature, decentralized foundation, and tangible value backing paint a canvas of a currency aligning seamlessly with the complex economic needs of an advanced multi-planetary society.

Finally, I haven’t delved into the Drake equation, but in my view, if there are other civilizations, they most likely do not utilize fiat currencies.

Powered by BTCPayWall