Many talks about “So-Called Stablecoins” or CBDC and refer to them as Fiat money.

How stable are these coins actually and what if you look at a longer period of time.

Most people would of course not want to lose money when they have worked hard and earned money, so you would assume to put them in a “So-Called Stablecoin”.

There is more to the story, because inflation, think monetary inflation.

Fed was born

President Woodrow Wilson signed the Federal Reserve Act in December 1913, culminating three years of discussion and debate over the development of a central bank.

The goal of FED as the most important institution currently in the world is: The Federal Reserve works to promote a strong U.S. economy. Specifically, the Congress has assigned the Fed to conduct the nation’s monetary policy to support the goals of maximum employment, stable prices, and moderate long-term interest rates

Let´s look at numbers

Let me know how much money you have would have got if you placed 100 USD in the bank in 1914? Yes you are correct, you would probably have 100 USD if the bank did not collapse, but the money would be worth way less. This is because of the purchasing power(CPI) of the money.

NB: I will not go deeper into the controversy about CPI –> COGI vs COLI + BLS vs Ranson Vs Williams.

Maybe you don´t trust me, but try this.

So, $100 in 1914 would have a purchasing power of $3,051.09 today.

Prices have increased $3,051.09 – $100 = $2,951.09 USD = 2,951.09% or 29.51 times over the last 109 years.

Let´s recalculate according to the original question. If you placed $100 in the bank in 1914, how would your purchasing power be today compared to then?

$100 / 3051.09 * 100 = $3.28 = 3.28% of the original value.

This shows how bad an investment it is to put your hard-earned money into a “So-Called Stablecoin”.

Remember that in a fiat economy where money is created by taking out new loans, the debt obligations will exceed the total amount of money in circulation. The problem can only be solved by pressing up more. The USD and other currencies working in fiat economies will therefore be diluted until they no longer have much value.

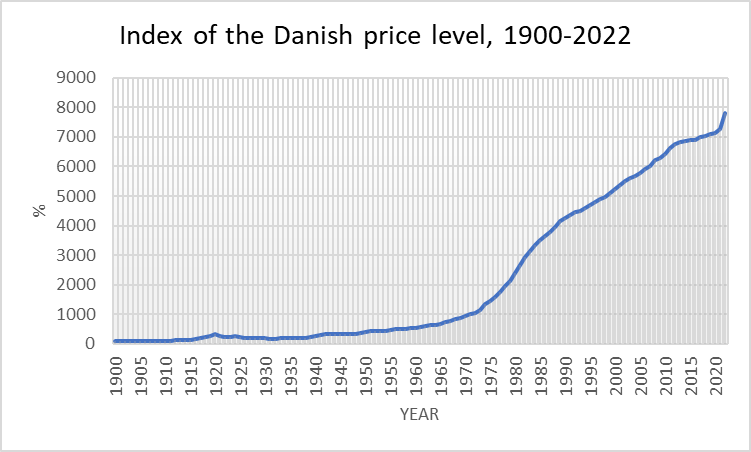

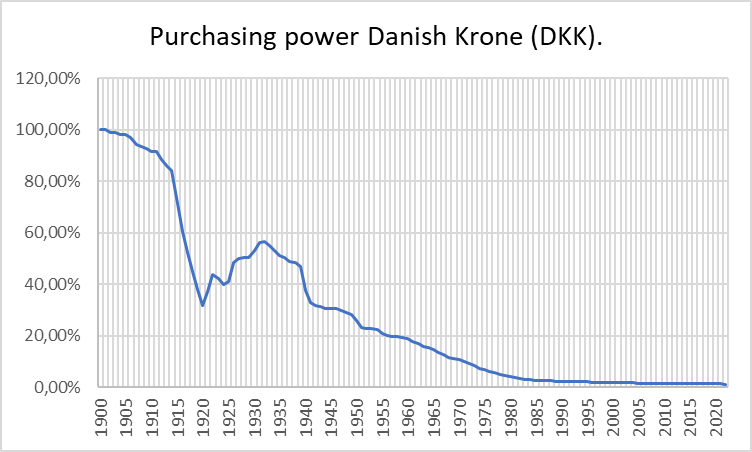

What about other central banks and their value preservation?

NB: I have calculated from 1900 (Index) and not 1914 like in the US, but it follows the same pattern.

DKK100 in 1900 would have a purchasing power of DKK7,819 in 2022.

Prices have increased DKK7,819-DKK100 = DKK7,719 USD = 7,719% or 77.19 times over the last 122 years.

Let´s recalculate according to the original question. If you placed DKK100 in the bank in 1900, how would your purchasing power be today compared to then?

DKK100 / 7819 * 100 = DKK1.279 = 1.279% of the original value.

All Fiat currency (So-Called Stablecoins) follow the same example.

Maybe try to compare the stock market (S&P 500 or Dow Jones industrial etc) or gold, silver market to the inflation in fiat money. You will maybe be surprised of some of the things you find and how clever capital move to other areas than fiat currency to preserve value. You will maybe also be surprised of how little the stock market since 1914 actually have moved if you adjust for inflation.

Conclusion

Fiat money has unlimited supply, it is not really backed by anything and it´s centrally controlled.

By having your money in a “So-Called stablecoin”, with time you will get your money eating up by inflation.

The US dollar is still controlling the world (dominant global reserve currency), but as a friend said: “The US Dollar is the cleanest shirt in the Dirty Politican Laundry”.

Extra

Debt will keep increasing see here.

One of the biggest Neo-banks in the world have included the Bitcoin Whitepaper on all their devices since 2018.

10 years ago a great SSVEP BCI music player was made with 90% of positive detection accuracy for every user that tried the system.

Remember the word Neuroergonomics and lastly a SSVEP song.