What governments are looking at, at the moment is how to implement features in their CBDC designs that can trick transactions, create illusions and for them make useful transferring technologies.

This is not optimal for the users of a CBDC if numbers are hidden away, the databases are closed and big amounts of user data are directly captured by states/Central banks.

Currently states/Central banks work closely with banks to send hidden transactions for funding of secret purposes the government wants. Earlier big amounts of cash were also often seen, but this is declining since it´s harder to use in many parts of the world.

If a bank/banks of a country have problems (systemic / G-SIBs) the government of the country (+sometimes other countries/banks with no interest in a collapse) will often bail them out in some way to first of all save themselves and their interests.

Three out of many reasons why Bitcoin is such an important concept is the openness/transparency directly on chain and that the monetary policy is predetermined. Especially the open ledger (Triple-Entry accounting system) and the decentralized nature of participating via mining and validating to ensure solving the issue of potential double-spending is very important in the long run for people worldwide. Nobody can freeze your money.

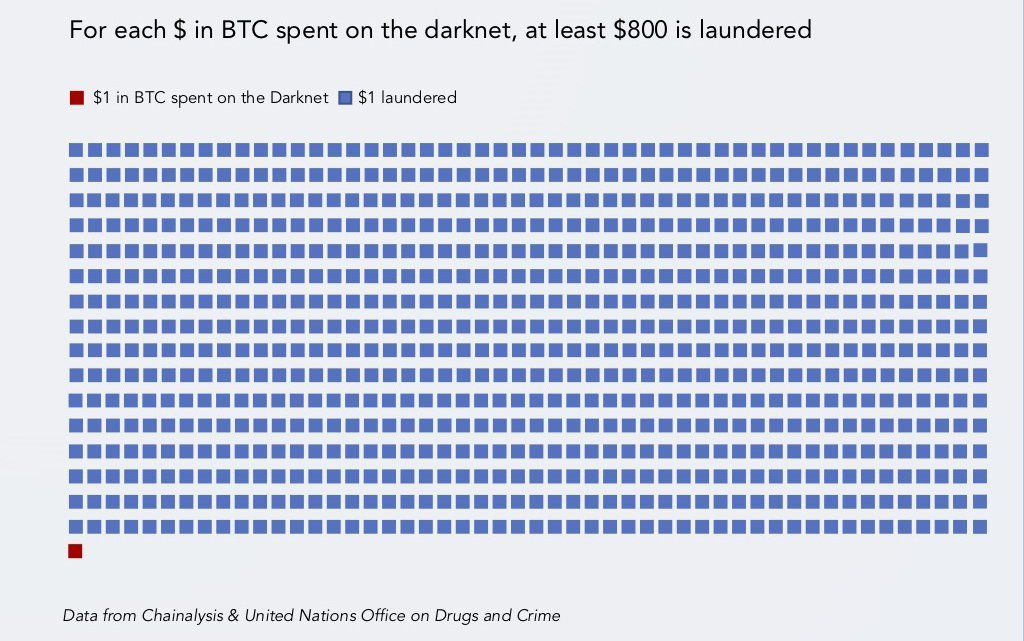

Of course, it will still be possible to make tricks with BTC and send them around to different wallets, buy/sell over the counter, use a mixer, use an unregulated exchange but the transactions can still be tracked back and seen – also when you use Lightning Network. Different firms are actively red-marking wallets that have stolen BTC via scams like Phishing, Ransomware, Blackmail, Sextortion, Impersonation, Fake returns, Contract exploits and other hacks.

What can be done with CBDCs?

The thing is that governments do different things to obscure their transactions and one of the biggest things is to donate to institutions in the partnerships they support, then the institutions will send the money via different routes and suddenly a country have access to a product (raw materials, weapons, medicine etc.).

Often Central banks who are lenders-of-last-resort will introduce swap lines and favor countries which holds a bigger share of their assets and/or are political aligned. So in the next years you will be able to see how many closed sourced CBDCs will get entangled and directly swapped – Will it be possible to watch these transaction real-time? I personally heavily doubt it.

Governments also buy votes by creating money “out of the thin of the air” and send it to people. This is often seen when governments wants to buy different voter groups or under Covid-19 where many people were handed government checks to keep their moral high during the pandemic/monetary inflation.

Governments also have connections to banks and will probably use some of their stable coins to obscure transaction later, but they actually don´t need this step since the CBDCs are in closed database aka closed sourced systems and only validated by the Central Bank itself.

Remember that governments will decide what terrorist financing is via labeling, so a country can send money to an institution/country today change the label so it becomes a terrorist institution/country tomorrow, and if you send money the day after you now support terrorists or your account is simple frozen.

Maybe take a look into some of these areas: Cash-intensive businesses, Structuring, Bulk-cash smuggling, Shell companies and trusts, Round-tripping, Trade-based laundering, black salaries, assigning life insurance policies or real estate.

Money laundering

Money laundering by states/countries normally follows three steps: Placement, layering and integration.

1: Create money by pressing a key in a Central Bank (central bank reserves/wholesale CBDC) introduce it to the “legitimate financial system”. Remember it´s almost free for a Central Bank to create new money since there is no process of Proof of Work (PoW) like under the Bitcoin or gold standard.

2: Move the money to create confusion – Wire or transfer the money through various accounts. Since the accounts often are using a closed sourced system, the public cannot follow the process (no real-time audit), but needs to trust what the state/government states they have been doing.

3: Integrate the money by making more transactions that seem legal, so the worthless “often newly created” money seems clean and integrated.

Trust Mathematics because Mathematics don’t lie

So, governments will probably not make money open and traceable with their new CBDC solutions even though it is very easy to do. Another bad thing about CBDC is the heavy monetary inflation that lenders of last resorts put on their users with their enormous debt creation (What is MMT?).

Following the money will get easier with public BTC and harder with private CBDC.

I currently don´t see any CBDC explorers, but I see many Bitcoin explorers (real-time audits) where I can follow blocks, transactions, fees, addresses, balances, OP-Return data and different protocol data.

A sound monetary system with Bitcoin will be a good thing for other sectors since trust and accountability are the root of Money and what financial sector/services handle for other sectors in an economy. If you cannot trust the root, you cannot trust the economy in a country/region/company.

Extra

Different countries are currently looking at the implications of Non-scattering, cloaking and broken symmetry via metamaterials – Why? Because Quantum radars can detect more than normal radars. Metamaterials will improve many things like your lens in your mobile phone or drone, but also many other areas will meet metamaterials sooner or later.

How often to governments audit their gold reserves and where do I find these audits? Bitcoin addresses and transactions are easy to audit.

Powered by BTCPayWall

https://www.aier.org/article/how-much-cash-is-used-by-criminals-and-tax-cheats/?v=dd65ef9a5579