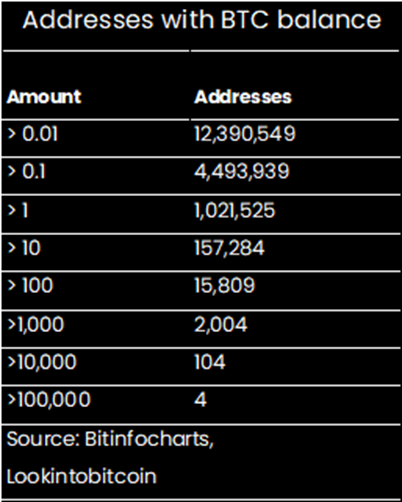

The Bitcoin wallet rich list comprises addresses with BTC balances. Many have heard of rich lists, but what do they truly signify? A rich list provides insight into how much value an entity or individual holds. Typically, this includes various assets such as BTC, commodities, bonds, stocks, real estate, land, patents, IP rights, fiat currency, and more.

However, for the purpose of this discussion, I will focus on BTC wallets.

What makes BTC unique is its open-source nature, allowing you to monitor every wallet and assess their activity, serving as valuable indicators.

You might wonder about layer 2 Lightning usage (locked coins in contracts), stablebitcoins, and derivatives based on BTC (such as futures and options). It’s true that these often operate within more closed systems that are challenging to track, but it is still possible to some extent.

It’s important to acknowledge that numerous individuals and organizations control multiple addresses. Some addresses even hold the BTC of multiple people and organizations. Additionally, there are addresses containing BTC that are currently inaccessible due to the loss of private keys, whether regular or multisig. The provided figure below is not entirely precise, but it offers a reasonable estimate. Please regard this figure as somewhat outdated, when you read this.

For those interested, I encourage you to explore the statistics related to unique active addresses used per day, month, or year on the Bitcoin network – a fascinating area to delve into – setup a full node.

Focus of centralized exchanges

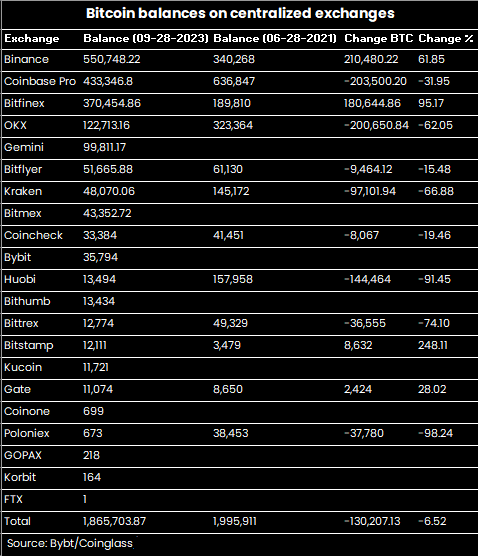

Reflecting on the changes observed over the past year, I couldn’t help but ponder the evolving landscape of centralized exchanges (CEXs), particularly after scrutinizing the FTX trial.

As mentioned earlier, some wallet addresses hold BTC on behalf of numerous individuals or organizations. The key concept here is custodianship.

Custodians often maintain cold wallets with substantial BTC holdings, which may encompass the assets of millions who utilize their custodial services. Think of CEXs, companies listed on the stock market, funds, ETFs, ETNs, and so forth.

Let’s examine the data from the past 9 quarters, covering a span of 2 years and 3 months, from June 28, 2021, to today, September 28, 2023. Given the improved data available today, I’ve gathered data points from 20 exchanges, a notable increase from the 13 exchanges considered in 2021.

It’s important to acknowledge that the data may be incomplete, and some exchanges may have undergone changes in management or ownership during this period.

It’s worth noting that traditional banks are entering the Bitcoin space, and while they may hold relatively small balances at the moment, many of them do not provide transparent reports for public scrutiny. Fractional banking has historically been a closed sector with limited access for the public. With on-chain tracking, it has become possible to trace addresses, but I’ll save a deeper discussion on this topic for another time.

However, I would like to emphasize the potential drawbacks of fractional reserve banking for ordinary citizens. It’s important to remember that nearly all people on Earth, regardless of their location or beliefs, are part of the fractional banking system, even though some may think otherwise. My focus is full reserve banking, which allows banks to lend BTC through time-deposits, where customers are able to lock up their funds for a specific period, and these funds can then be lent to borrowers.

In the current debt-based system, there is limited financial freedom, and surveillance is becoming increasingly pervasive. I do not support governments gaining more insight into the financial affairs of ordinary people through Central Bank Digital Currencies (CBDCs), especially when this information can be combined with other data. Such a scenario could easily lead to a form of government-controlled social scoring, potentially resulting in a communistic regime where governments exert greater control over their citizens.

I will stay vigilant, as evidenced by the increasing government scrutiny of personal communications in the EU, extensive camera surveillance on government-controlled infrastructure, and government-developed apps that collect extensive user data from phones, computers, digital watches, and other devices. While companies are profit-driven and also engage in data tracking, they seldom wield power over individuals in the same way as governments do.

Extra

Currently, there is a significant debate regarding the time lag between spot and futures trading in BTC. You can find more information on this topic by reading here.

Big companies are forming post-quantum cryptography coalition to secure Bitcoin.

Antimatter falls down, not up: CERN experiment confirms theory.

I’ve observed that integrating control testing into machines is often more reliable than relying heavily on humans. When individuals use machines, they sometimes forget to question the reliability of the results.

In the context of machines, errors around reliability often arise due to issues with proper time intervals, calculations, and understanding control data limits. If a machine can provide results in a file (CSV, PDF etc.) format, it can be both cost-efficient and more precise. In the case of medical machines, a standard practice includes calibrating assays (by inserting them into the machine), employing negative and positive controls (also inserted into the machine), and utilizing internal control/calibrators. Machines can be configured to perform control tests after a specific amount of time or usage (samples/batches etc.).

While humans still play a role in providing inputs and controls to machines, stationary machines are increasingly becoming fully automated, allowing humans to relax and focus on other tasks. Furthermore, it’s advisable to conduct multiple tests on the same sample or cross-test samples using different machines and methods to ensure consistent results.

Consider this: Do you know the acceptable percentage range for fluctuations in your last blood test? Did your last blood test report include information about when the machine underwent its most recent control test or calibration? I anticipate that, in the future, such details will become standard in all medical test reports for individuals purchasing tests (Vestorp stamp). Calibration and quality control tests results from each machine could be integrated into a Layer 2 solution in Bitcoin (to avoid congestion on the Layer 1 network), allowing people to directly access and link the machine control/calibration data to digital open-sourced records (in real time). It’s important to note that people’s test results should not be public to everyone, but information regarding machine calibration and quality controls should be made available.

It’s crucial not to blindly trust machines or the companies/people providing results unless they provide this vital information for transparency and accountability. If you are interested in medical machines it’s also worth exploring the principles of the “Westgard rules”.

Quote:

Trading can encompass various methods derived from other areas of research.

Powered by BTCPayWall