Welcome to the site and my first blog!

Still not sure if I like this format, but sometimes I like to try new stuff. Actually, I like to keep things more private and build business, but why not try!

Just so you understand my English tend to be rubbish since I am not a native, so now you know.

This first blog will be about the interesting things happening in the banking sector at the moment. I am a big believer in Bitcoin (BTC) and have been for a long time. I have actually made businesses around this great currency and will do again.

I might write in a simplistic form and since this post is social science it might be very wrong. Remember I am not your financial advisor!

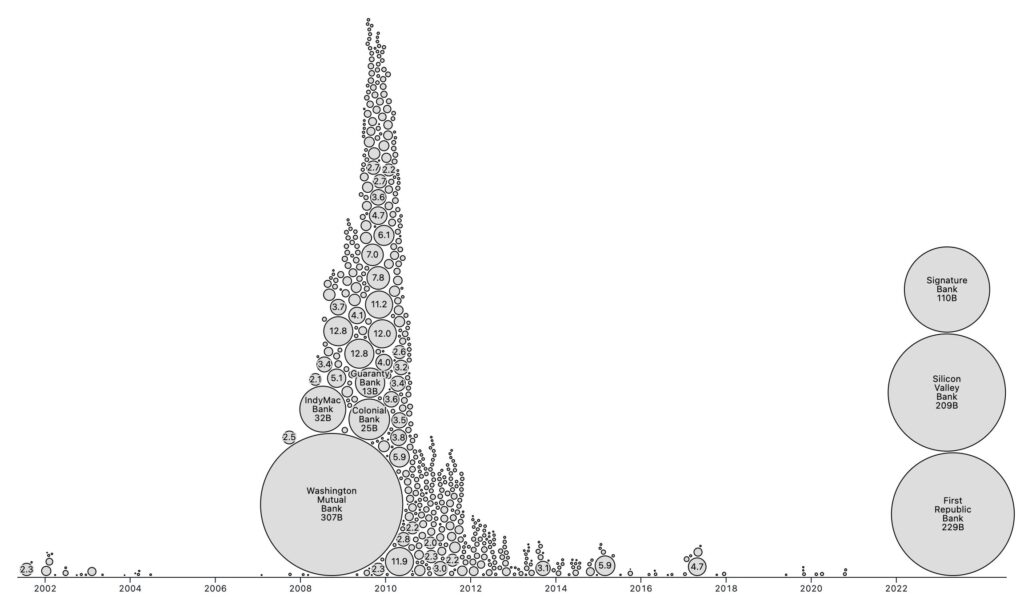

Right now, there is a crisis like the crisis I remember from back in 2008-2010. Banks are falling apart both in US and Europe and I don´t think we are done. Take a look at what happened in 2007-2010 in the picture and here.

It all started with SVB. Will history write they started the Greater recession, I think so. To understand what a bank run is look here.

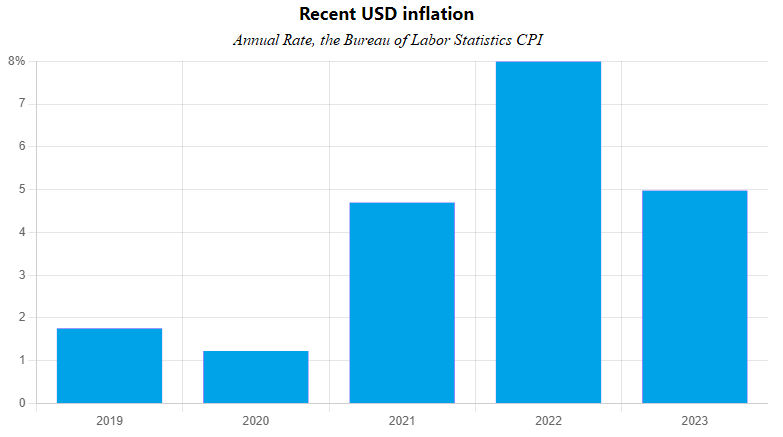

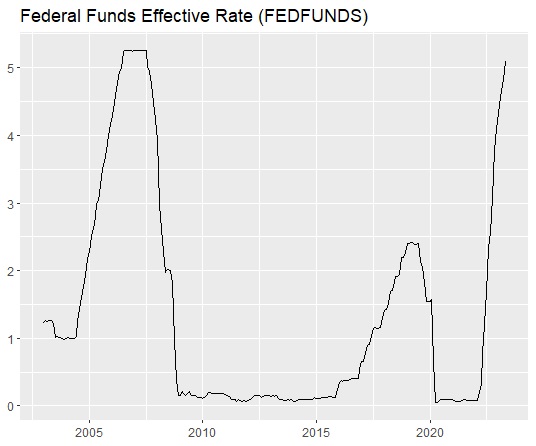

The Central Banks right now have another focus and that is bringing inflation down + maybe also another agenda?

And this is done with increasing interest rates. Increasing the interest rate push more Bank M&As.

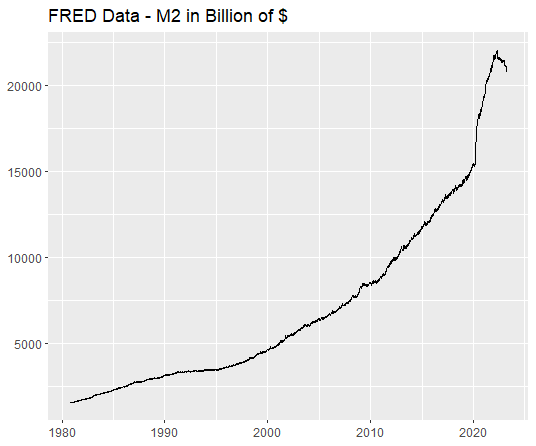

What started the inflation and now the rate hikes? The massive money printing during COVID-19.

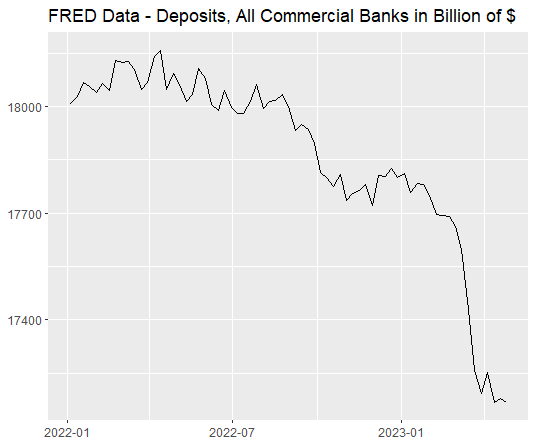

At the same time regular people are withdrawing their deposits and this kills the small regional banks in the US.

This causes distress in the financial sector. But were the banks not supposed to be ready for this with all their stress-tests? Surely not, so maybe it also indicates failure of bank management and supervision?

A new article shines some light on the current situation in US.

Banks in Europe have started adopting the Digital Yuan (Chinese CBDC), probably to survive in the current environment, so they don´t collapse like Credit Suisse. BNP-Paribas just made an announcement yesterday.

I have an idea about what is happening, but you have to wait for the mempool and the newly inscribed NFT you can buy (hopefully) tomorrow since the transaction fees currently are super high.

Little extra:

Rough estimates:

How much value is 1 dollar worth now compared to 3 years ago (Purchasing power – CPI)?

= 85 cents.

How much value is 1 Euro worth now compared to 3 years ago (Purchasing power – HICP)?

= 87 cents.

These measurements could have been stated in core inflation, personal consumption expenditures or chained inflation, but most probably understand CPI/HICP.

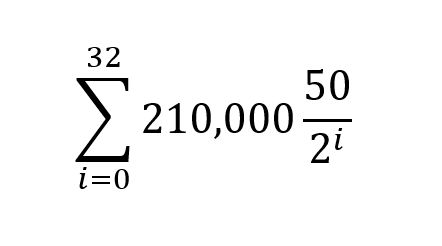

Save in BTC and be happy. BTC fluctuates (measured against other commodities/fiat) yes, but nobody can just suddenly print more and change the formula!

Powered by BTCPayWall