Today (July 20, 2023) the Federal Reserve (USA) launched FEDNOW an instant account-to-account payments rail. This is what some call an account-based CBDC. A token-based model is not in play yet by the FED. The Stablecoin Tether offer a token-based solution with their USDT token pegged to the US Dollar.

TCHs (The Clearing House) RTPs (Real time payment) went live in 2017 six years ago and is pretty much the same as FEDNOW, other than they have implemented a token-based CBDC solution inside it´s account-based system – read here.

Now there are two RTP rails in USA from the state.

Read more about it here.

Bitcoin has been live in USA and all around the world as a RTP rail since January 2009.

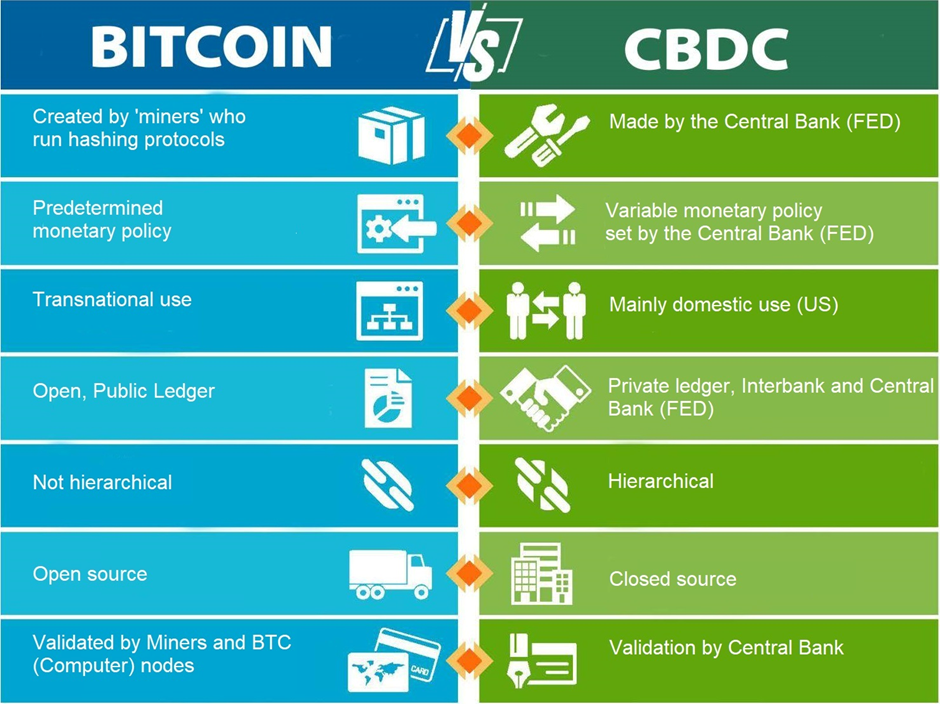

There are some differences between CBDCs and the projects currently live around the world.

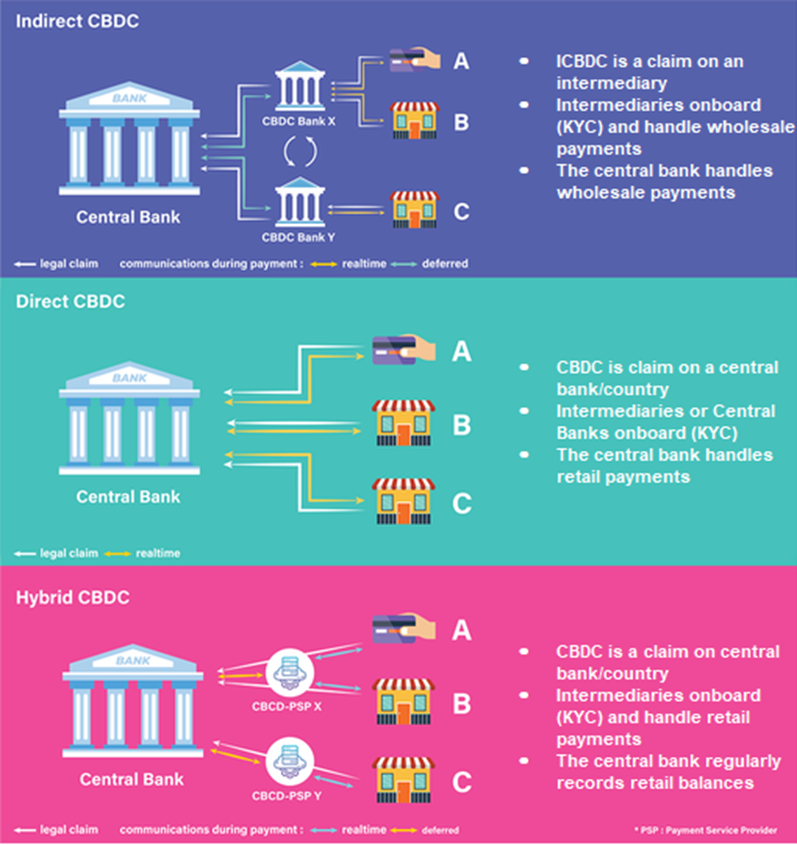

Here is a figure of some of the designs.

Figure 1

The FEDNOW project is a Hybrid CBDC. The FEDNOW system and the Reserve Banks will provide access to intraday credit (Wholesale CBDC) to participants of the FedNow Service during the Federal Reserve’s normal operating hours, and a liquidity-management tool to help participating financial institutions conduct interbank transfers during hours when the Federal Reserve’s normal liquidity services are not open (e.g., on weekends). Early adopters of the system can be seen here.

Other countries have different other takes on CBDCs as Figure 1 also show + countries use different cryptography, some use Quantum resistant systems others not, some want more privacy via ZKP and some use token-based systems implemented in account-based systems(like TCH) and some token-based systems etc.

Alternatives in US

Right now, are there a few alternatives to FEDNOW and TCH with same instant transaction functionality in the US. This is Bitcoin (BTC), BTC via Lightning Network, Tether (USDT), CashApp, Paypal (Paypal and Cashapp don´t use interbank networks), Venmo and Card providers like Mastercard and VISA.

It will be interesting to see what will happen and if this account-based CBDC system will end up to tax, surveil and control the American people.

Figure 2

Remember: Any financial institutions with access to U.S. instant payment systems or stablecoin service providers operating in the United States would be generally subject to U.S. AML/CFT obligations. Stablecoins are generally not distinct from other digital assets, and financial institutions offering services in stablecoins in the United States are subject to the same AML/CFT regulatory and supervisory framework as financial institutions providing the same services with other financial instruments. Check out the U.S. Department of the Treasury Report on the Future of money and payments from September 2022.

Extra

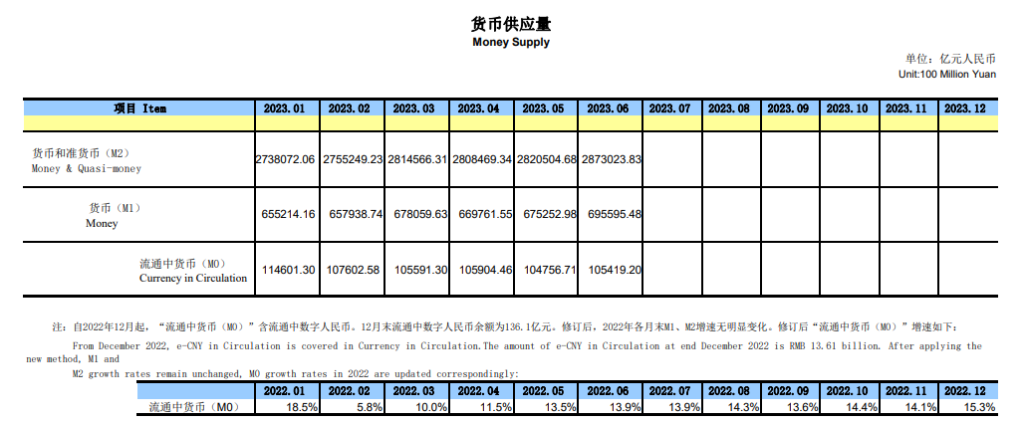

It´s is still hard to see how much e-CNY there actually are in circulation since China´s PBC, the last seven months have stated the same thing, only giving the December number, but with all their initiatives, shouldn´t the circulating supply not suppose to increase?

BTW: How do you think this will help American citizens to faster onboard to BTC and will this increase adoption? Today (07202023) BTC has dipped around a 1% to 29.700 USD.

Powered by BTCPayWall